Introduction

Research Background

Joint ventures enable construction businesses to engage in global construction markets, which is a direct result of globalisation [7]. Forming an international joint venture offers several advantages, such as the opportunity to distribute risks, enhance operational capacity, penetrate new overseas markets, and attain a competitive edge. When many firms from different countries establish an international joint venture (IJV), several factors need to be considered, such as politics, culture, legislation, technology, management, and economics [5]. Regrettably, a number of International Joint Ventures (IJVs) have collapsed as a result of the inherent risks involved. The failure rate of foreign joint ventures exceeds that of local ones [4]. More than 50% of IJVs fail in poor countries, whereas over 30% fail in affluent ones. Additionally, between 70% and 80% of planned joint ventures never begin [10].

Joint ventures may serve as an effective means for both local and global corporate management to achieve their objectives. At a minimum, they enable one party to benefit significantly from the strengths of the other [3]. Local partners may provide valuable knowledge about the home market, assistance in navigating regulatory frameworks, expertise in the local labour market, and even access to pre-existing manufacturing facilities. Foreign investors may bring in cutting-edge process and product technologies, valuable managerial skills, and opportunities to tap into new international markets for export. The need for initial capital to begin a new firm may be reduced if either of them forms a partnership with another organisation. Although joint ventures may seem advantageous, they often arise unexpectedly and fail to meet expectations. This phenomenon persists even when the enterprises involved are situated in the same industrialized country. However, partnerships that span across international boundaries are much more prone to this issue. A significant number of participants in the subsequent research conducted by [2] expressed dissatisfaction with their performance. The research will cover more than fifteen future collaborations in developing markets as case studies.

Research Aim and Objectives

The proposed research aims to determine the possible risks and advantages involved with joint ventures in the nations of the third world. By applying literature reviews, empirical data collection, and analysis to the factors shaping the joint ventures in this context, the study will improve understanding of how differently the ventures end despite the similarities. Through the identification of shared challenges and the delivery of best practices, as well as risk mitigation strategies, the study aims to support the private sector, policymakers, and practitioners in order to help them in the execution of joint ventures. The research objectives are as follows:

- To examine the main drivers that prompt local and multinational enterprises to engage in IJVs in emerging countries.

- To assess the advantages and disadvantages encountered by both parties involved in an IJV inside emerging economies.

- To analyze and deliberate on the suitable approaches for reducing risk factors encountered by IJVs in emerging economies such as Africa.

Research Questions

The researcher will seek to answer the following research questions:

- What are the main drivers that prompt local and multinational enterprises to engage in IJVs in emerging countries?

- What are the potential hazards and advantages of IJVs on the economic development of African countries?

- How can the risks associated with IJVs in emerging economies like Africa be mitigated, and the chances of benefits be enhanced?

Relevance and Scope of the Research

Examining the organizational risks and rewards inherent to market dynamics, this research (Killing, 2017) elucidates the similarities and contrasts between MNCs and their local subsidiaries. The case study of American and European MNCs that have approached or entered the African market via IJVs is the backbone of this research. An examination of the business climate influencing the joint venture has benefited greatly from this research. Because of this, the researcher has been able to examine the similarities and differences between two commercial activities in IJVs and two radically different organizational cultures (Debellis & Pinelli, 2020). By offering practical guidance and pertinent data, this research will assist future global joint ventures in reducing risk, increasing profits, and making more sustainable use of resources.

In this research, the researcher will review and examine the potential pitfalls and upsides of IJVs in the context of marketing product development. At the corporate level of a newly formed international firm, it is also feasible to investigate cultural differences in different markets. The author opts for an equity joint venture structure since it promotes shared ownership. The researcher now has a full view of the risks and rewards shared by all parties engaged in the joint venture and a better idea of the degree to which the parent businesses’ activities differ from one another. The researcher is also limited in their scope since they had to mainly consider the ways in which the parent companies of the joint ventures have institutionalized national and organizational duties. Unfortunately, the researcher will not be very successful in obtaining secondary materials from the present literature. While acknowledging the importance of cultural factors, the author has mostly concentrated on the consequences of IJV risks and advantages for organizational management in developing nations.

Literature Review

One description that fits joint ventures well is the idea that two or more organisations can do more than what each one of them could achieve alone [10]. To provide a picture of the enterprise’s fundamental motives and aims, this definition of a joint venture goes much beyond the basic idea of a partnership. Given the lightning-fast pace of change in the global market, the concept of international joint ventures has been enthusiastically embraced by the business sector as a means to achieve quick growth and market sustainability.

[1, 6, 9] explain that joint ventures have helped many companies enter new markets, sparked innovation, and prompted a change away from the conventional methods and structures used by the status quo. Joint ventures play a crucial role in any strategy aimed at breaking into or growing an existing international market. It would be detrimental to the cause to downplay the importance of several contributing factors. Such factors include, but are not limited to, differences in cultural norms, the dissemination of new knowledge, and the development of an organization. Additionally, many other issues, including ownership arrangements and management practices, are present throughout this process.

The potential financial outcome of a company’s decision to assume a risk depends on the specific nature of that risk, with the possibility of either gaining or losing money. Many writers have categorised the hazards of IJVs into distinct groupings based on their origin or level of similarity [6]. Government interference in corporate activities is an instance of the political hazards mentioned in [2]. Examples of such interventions include monetary manipulation, restrictions on immigration, repatriation policies, and coup d’état. The profitability of the effort is directly influenced by financial risks such as taxes, currency exchange rates, credit ratings, and inflation [7]. The host country encompasses three discrete kinds of risks: internal, project-specific, and external.

The intrinsic dependency between participants in a joint venture creates significant challenges in predicting the evolution of underlying circumstances before the agreement is signed [4]. Upon acquiring further knowledge, one spouse may see the other’s endeavours from a new perspective. Initially, a spouse from an economically disadvantaged nation may provide a limited understanding of local customs and procedures. Nevertheless, when the multinational corporation acquires a more comprehensive understanding of the local circumstances, its worth may decrease. Technological advancements might lead to alterations in relationships. If unexpected advancements in product or process technology arise, it is conceivable for any or both parties to assert that the joint venture is no longer required. As stated by [5], in order to sustain profitability, it will be imperative to transition to higher-priced manufacturing methods that include state-of-the-art technology. Significantly more investment may be necessary for this transformation to occur, and although one partner may be amenable to this, the other may not be.

Culture has a crucial role in the merger of two major multinational enterprises. The presence of cultural differences is magnified in an international connection. [15] argues that when two cultures collide in a worldwide collaboration, a new organizational culture emerges. The impact of cultural variations on the establishment of a worldwide joint venture has been well examined and documented [14]. Based on several studies and surveys, the convergence of organizations with very distinct cultures might result in conflict and, ultimately, the dissolution of the partnership. [12] identified three primary causes for the breakdown of alliances: ineffective communication, a lack of cultural compatibility, and an absence of a shared goal.

Due to the intricate nature of their organizational structure and the volatile nature of the host nation situations, they had a significant and complete failure. Most of the existing work on IJVs has focused on identifying the reasons for their failure [13]. The existing body of research on risks encompasses a wide range of topics, such as risk identification, assessment, ranking, prioritization, management, treatment, and even risk preferences. The study conducted by [12] focuses on the influence of risks on the efficiency of IJVs. Recent advancements in risk management and transmission in IJVs have led to the development of novel analytical and computational models. The potential hazards that might disrupt an IJV can be categorized into three primary types: internal, project-related, and external [14].

Conversely, several studies have conducted in-depth investigations into the possible problems associated with IJVs [10]. Research may include both narrow and wide scopes, yet it is common for several research studies to have similarities [13]. [12] characterizes a loss of management control, cultural differences, language hurdles, and related issues as threats, while [15] considers them as constraints. This research aims to conduct a thorough analysis of the existing literature by identifying prospective features that are known to have a negative influence on the performance of IJVs [11]. Management must promptly address the situation as their level of assurance has increased [9]. The failure of IJVs may be attributed to a variety of factors, including issues, problems, impediments, challenges, and difficulties. [2] define risks in the context of IJVs as uncertainties that either have positive or negative effects on the achievement of development objectives. By ensuring that management response choices for IJVs are uniform and that they recognize the distinct risks and obstacles involved, they may adopt a more proactive approach. The coherent development cycle of an IJV consists of four phases: pre-inception, formation and organization, implementation and adjustment, and completion and assessment. Events may grow more intricate and disastrous as dangers and obstacles accrue over time throughout the evolutionary process [9]. The result is a series of negative consequences that lead to the scattering of management strategies, ultimately resulting in subpar performance or outright failure. An adequately designed management response strategy or framework is essential for the efficient and successful running of IJVs.

Proposed Research Methodology

This research aims to systematically analyse and synthesise existing literature about the advantages and disadvantages of IJV. This study will collect, use, and incorporate secondary qualitative data via a thorough examination of existing literature. This research will use its results to analyse 15 actual instances of joint ventures with multinational companies (MNCs) that have extended their operations into African markets. To get reliable and sufficient data, the researcher will refer to books, peer-reviewed journals, and organisational papers related to the specified IJVs of MNCs in Africa. In addition, the researcher intends to locate these secondary resources using internet platforms and the school library. During the identification step, the researcher will do a comprehensive online search of the whole study topic. Subsequently, the sources that are relevant to developing countries, particularly African states, will be further narrowed via the use of the inclusion and exclusion technique. Over ten years have elapsed since the authorities should not have been disclosed. Subsequently, the researcher will gather relevant data and information by consulting diverse sources, analysing the similarities and differences in their perspectives on joint ventures (JVs), and evaluating the benefits and drawbacks they provide to corporations seeking to grow into developing countries such as Africa. Subsequently, the researcher will evaluate the findings of the study, formulate conclusions, and interpret the data using charts and tables.

This research is anticipated to include a substantial number of literature sources. Only articles that undergo a rigorous peer-review process and are widely circulated in the academic community will be selected for this research. Only editorials, book reviews, conference papers, debates, and closures that have been sourced from a credible source will be included. [11] found that journal papers are seen as a more dependable source of information and are deemed to be “certified knowledge” inside the academic domain. Multiple prior studies have conducted comprehensive examinations of relevant subjects within the realm of construction management. The provided sources should have been published or created during the last decade, namely from 2014 to the present. Despite taking this step, inconsequential articles persisted in appearing due to their alignment with certain search phrases. The whole sample will be divided and undergo a thorough evaluation and examination across many research days to eliminate irrelevant articles. Publications that mentioned the IJV but did not primarily focus on Africa were considered irrelevant. Journal papers that did not undertake a comprehensive study on IJV but instead used it as a framework to analyze another phenomenon were also excluded. By only considering conclusions supported by empirical evidence, these criteria enhanced confidence in the combined results. Following a meticulous evaluation, a minimum of 40 sources will be selected for inclusion.

Proposed Research Timeline

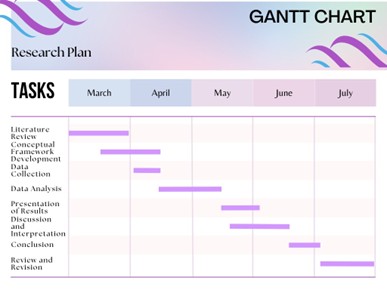

The literature review will be conducted before the study starts; it will include examining research reports on joint ventures in developing economies, with a focus on possible risks and potential benefits. In the first month of March, the first objective will be to collate and evaluate relevant articles, books, and research reports in order to grasp the overall conceptual framework. On completion of this, April will be utilized for the further narrowing of the research focus and the identification of the major themes and variables to be examined. May is concerned with the ideal development of a framework that outlines the research methods, for example, the type of data that will be collected and the preferred techniques for analysis. June will be levied for collecting data with the help of surveys, case studies, or interviews. I will choose one of the methods that will depend on the method of my research. In July, I will be performing the data analysis portion. This will be a time to make connections, spot trends, and try to prove theories from the observations collected. Lastly, in August, the focus on the writing of the research paper shall be done, which will entail a dialogue on findings, implications, and suggestions for future research projects as well as business practice.

Figure 1: Research Gantt Chart

Expected Research Results

The aim of the investigation on the probable factors of risks and benefits for alliances in emerging economies is comprehensive. Methodologically, the proposed study will adopt a mixed-methods strategy, consisting of a comprehensive review of the existing literature and qualitative data collection from content analysis. This literature review will provide a theoretical background and identify gaps in the currently existing knowledge. As such, it will also present the results of the quantitative analysis that will help demonstrate the frequency and relevance of various determinants and protectors. A qualitative data collection route will be taken here because of the depth it adds to the investigation of participants’ experiences and perceptions, which is very necessary [16]. This research is likely to discover the spectrum of possible risks, from interethnic conflicts and political instability to Infratech issues in law and regulations and difficulties in the cooperation of partners and resources management. Oppositely, planned gains may deal with markets and resources, as well as technologies, know-how, and capacity building. However, it encompasses knowledge transfer and networks. Apart from that, it identifies possible limitations and difficulties, which include sampling errors, complicated issues of data validity and reliability, and the fact that development processes in these various countries are dynamic and multi-context [17]. Risks involving joint ventures, such as a conflict of interest, imbalances on common grounds, and strategic misalignment, will be put forward for consideration alongside risk and conflict resolution strategies. Another aspect that the research will cover besides the physical factors is the role of external elements such as government policies, economic status, and the condition of the market. Generally, the study will be carrying out findings that can inform businesses, policymakers, and other stakeholders who need to make the right decisions in regard to the joint ventures in developing economies, meaning that the advancement of these ventures will be not only effective but also sustainable too [16].

Conclusion

The goal of the study on the risks and benefits of involving partners from developed economies is to highlight the factors that influence both the academic and pragmatic applications of such joint ventures. Firstly, it attempts to enhance scientific knowledge through the synthesis of existing information and identification of relevant calls for a complete theoretical framework that explains the multiplicities encountered when joint ventures are engaging in diversified contexts in developing countries. The study seeks to achieve this holistic picture by carefully combining qualitative and quantitative methodology through the lens of dynamics and management of factors involved in the success or failure of joint ventures. Secondly, the study also outlines applicable information and relevant suggestions for business players, policymakers, and practitioners who are in a joint venture adventure or to launch it in the immediate future in developing economies. Identifying factors similar in nature, such as risks, challenges, and best practices of joint ventures, leads to the generation of knowledge that is beneficial to strategic decision-making and enhances the chance of the tactical implementation of joint ventures by the investors. The result might be useful in making guidelines, tools, or training, all geared towards boosting the skills of parties to facilitate the dynamic nature of joint ventures in these spheres of activity. As the study concludes, the findings serve a significant function in enhancing the productivity of the organization, thereby facilitating knowledge transfer and growth in developing countries.

References

[1] A. Ifechukwu, “Regulating Fintech in Developing Economies: Examining The Risks, Policies and Nigeria’s Path to Financial Prosperity,” SSRN Electronic Journal, 2022, Published, doi: 10.2139/ssrn.4312289.

[2] A. P. C. Chan, M. O. Tetteh, and G. Nani, “Drivers for international construction joint ventures adoption: a systematic literature review,” International Journal of Construction Management, vol. 22, no. 8, pp. 1571–1583, Mar. 2020, doi: 10.1080/15623599.2020.1734417.

[3] A. Razzaq, M. J. Thaheem, A. Maqsoom, and H. F. Gabriel, “Critical External Risks in International Joint Ventures for Construction Industry in Pakistan,” International Journal of Civil Engineering, vol. 16, no. 2, pp. 189–205, Nov. 2016, doi: 10.1007/s40999-016-0117-z.

[4] B. Bunce, “Dairy Joint Ventures in South Africa’s Land and Agrarian Reform Programme: Who Benefits?,” Land, vol. 9, no. 9, p. 328, Sep. 2020, doi: 10.3390/land9090328.

[5] B.-G. Hwang, X. Zhao, and E. W. Y. Chin, “International construction joint ventures between Singapore and developing countries,” Engineering, Construction and Architectural Management, vol. 24, no. 2, pp. 209–228, Mar. 2017, doi: 10.1108/exam-03-2015-0035.

[6] D. A. Pentsov, “Contractual Joint Ventures in International Investment Arbitration,” SSRN Electronic Journal, 2018, Published, doi: 10.2139/ssrn.3214785.

[7] Dr. A. K. Alkhalifa, “Perspectives on Networking in the Management of International Joint Ventures,” Journal of Advanced Research in Dynamical and Control Systems, vol. 12, no. SP7, pp. 343–351, Jul. 2020, doi: 10.5373/jardcs/v12sp7/20202115.

[8] I. Batra and S. Dhir, “Developing structural modeling of inter-partner factors of international joint ventures performance,” International Journal of Productivity and Performance Management, vol. 73, no. 1, pp. 186–209, Nov. 2022, doi 10.1108/ijppm-12-2021-0714.

[9] L. Shen and S. O. Cheung, “How forming joint ventures may affect market concentration in construction industry?,” International Journal of Construction Management, vol. 18, no. 2, pp. 151–162, Apr. 2017, doi: 10.1080/15623599.2017.1301026.

[10] M. A. Montoya, “International Joint Ventures Among Developing Country Multinationals: The Case of Salinas Group-FAW,” SSRN Electronic Journal, 2014, Published, doi: 10.2139/ssrn.2398630.

[11] M. O. Tetteh and A. P. C. Chan, “Review of Concepts and Trends in International Construction Joint Ventures Research,” Journal of Construction Engineering and Management, vol. 145, no. 10, Oct. 2019, doi: 10.1061/(asce)co.1943-7862.0001693.

[12] M. O. Tetteh, A. P. C. Chan, A. Darko, S. K. Yevu, E. B. Boateng, and J. M. Nwaogu, “Key drivers for implementing international construction joint ventures (ICJVs): global insights for sustainable growth,” Engineering, Construction, and Architectural Management, vol. 29, no. 9, pp. 3363–3393, Aug. 2021, doi 10.1108/exam-07-2020-0512.

[13] M. Solange, “Towards attaining efficient joint ventures in international construction: the case of Saudi Arabia,” Engineering, Construction, and Architectural Management, vol. 30, no. 6, pp. 2545–2563, Apr. 2022, doi: 10.1108/exam-07-2021-0647.

[14] N. Khatiwada and Z. Hong, “Potential Benefits and Risks Associated with the Use of Statins,” Pharmaceutics, vol. 16, no. 2, p. 214, Feb. 2024, doi: 10.3390/pharmaceutics16020214.

[15] R. J. Greene, “Effective Rewards Strategies for Mergers, Acquisitions, and Joint Ventures/Alliances,” Compensation & Benefits Review, vol. 46, no. 5–6, pp. 287–291, Oct. 2014, doi: 10.1177/0886368714565061.

[16] S. T. Do, V. T. Nguyen, and V. Likhitruangsilp, “RSIAM risk profile for managing risk factors of international construction joint ventures,” International Journal of Construction Management, vol. 23, no. 7, pp. 1148–1162, Aug. 2021, doi: 10.1080/15623599.2021.1957753.

[17] W. M. D. Y. Sandaruwan, M. Francis, and T. N. Liyanawatta, “Risk assessment of construction joint ventures in Sri Lanka,” International Journal of Construction Management, pp. 1–14, Mar. 2024, doi: 10.1080/15623599.2023.2299540.